CLIENT

INFORMATION

Buying Your Property

Once the agents have confirmed to you that your offer has been accepted, they will ask for details of your solicitor. Some agents may try to persuade you to use their recommended conveyancer. Sometimes this is with the best of intentions and sometimes it is because that conveyancer pays them a fee for the introduction! Simply tell them that you would prefer to use your own solicitor. They should not be offended!

The agent will then arrange for a Memorandum of Sale to be sent to all parties. The memorandum of sale will give us details of what has been agreed in terms of the property, price etc and of the seller or his or her solicitor. You will know when we have received those particulars as you will receive from us a letter confirming this and detailing any further information that we need from you.

If you have already contacted us we will have sent you a formal quotation letter and a questionnaire form to fill out for us. If you have not already received the form it will be sent to you at this point. We apologise for the intrusive nature of some of these questions but when we act for you in buying a property we also act for your lender.

We have some requirements that we have to satisfy so far as that lender is concerned and a number of the questions that we ask relate to those issues. Some of the questions are merely for our purposes to help us contact you when necessary or to chase other people on your behalf. Please give us as much detail as you have available at the moment but do not delay sending the form back. Any missing information can be picked up later.

You should, of course, let your financial advisor or lender know who your solicitors are so that they can send us a copy of the mortgage offer when the time comes.

You should at this point also consider whether you are going to take out your own buildings insurance (unless the property is a flat) or whether you are going to take the buildings insurance offered by your lender.

If you are going to take out your own buildings insurance, this should be in force from exchange of contracts (except in the case of new properties). We will need details of your insurance before the date of completion, as we may have to pass these details on to your lender.

When we receive the draft contract from the solicitor acting for the seller, we will immediately send you as many of the following items as are available at this stage.

- A copy of the plan of the property. You must please check the plan and let us know if it differs from the situation on the ground. Remember that the conveyancing process does not allow for us to personally inspect the property.

- A copy of the fixtures and fittings and property information forms completed by the seller. If you have agreed to purchase any additional items you have a choice as to whether you wish to let us know and we can add it to the contract or whether you wish to make a private arrangement with the seller in which case we will not get involved.

- Copies of any guarantees that are with the paperwork. We can not comment on the validity of the guarantees. They are only as good as the company who has issued them. Some guarantees are only valid if officially assigned to you as the new owner. We can not do this for you. This will be for you to arrange, and pay any necessary fee, after completion.

- Copies of the title deeds with a note of any specific matters that we feel that we need to draw to your attention. The “covenants” that affect the property will be pointed out to you. They are important and if you think that any of them may already have been breached you need to let us know. A typical example of a covenant is “not to make alterations to the property without the consent of somebody (usually a previous owner or builder). If you are planning to make any alterations to the property after you have bought it and you think that this kind of covenant may affect your plans you need to let us know so that we can talk over the implications with you.

- A contract that you will be asked to sign. You should check that the purchase price is correct and that we have your names spelt correctly before signing where indicated. This is the only one of the documents that we have sent you that we need back at this stage.

- A copy of any letter that we have sent to the sellers solicitors raising questions that have arisen as a result of our examination of the paperwork. Some of these will be technical in nature and some practical. If you have any questions that you would like to raise please fell free to raise them now.

During the course of the transaction you will also receive copies of any other correspondence that contains anything of relevance. Sometimes this correspondence will come with a covering letter, and sometimes not. If it does not come with a letter from us this is because we think that it will be of interest to you and it does not necessarily require any comment.

This does not mean that you can’t discuss the postal report with us on the telephone. It is very important that you fully understand the implications of what may be the most important purchase that you will ever make.

We may not telephone you unless we have anything of importance to discuss but if you feel that you have not heard from us for a while, you are welcome to telephone for a progress report. If we have nothing to report then we will say so but we are pleased to have had the contact and we can decide, together, if there is anything else that either of us could, or should, be doing.

We are often asked whether you should have a survey. The only advice that we can really give you is that you are making the most important investment of your life and you should use this as an opportunity of making the fullest possible enquiries. This of course includes a full survey.

In the case of the survey that we recommend the surveyor will, as part of the survey, take a couple of hundred photographs which you can use later on for evidence should you need to make a building insurance claim later on. With the photographic evidence of an expert then it would be more difficult for the insurance company to argue that the problem was there when you bought the property!

A survey of your own may also assist you in making an argument for a reduction in the purchase price!

When you receive your survey you should read it carefully and if there is anything that you feel needs further investigation or if you feel that the price should be reduced then you will need to arrange this through the estate agents before exchange of contracts. Any reduction in price needs to be notified to the lender as it may affect the mortgage offer.

We are happy to recommend the following surveyors: Tim Kenny and Rob Kenny

If you are obtaining a mortgage, it will be a requirement of your lender that we obtain for you an up to date Local Authority (usually referred to as just Local) search result. If you are not obtaining a mortgage it is up to you whether you have a local search or not. We always advise you to have this search.

The local search result will only cover the property that you are actually purchasing. It will NOT tell you what is going on in the local area or, indeed on your neighbour’s property. If we do have any relevant local knowledge then we will share it with you BUT we can’t know about everything that is proposed for the area. If you have any particular concerns please raise them with us specifically and we will see what we can find out for you.

If you are buying a property with open land around it please keep in mind that Government pressure on councils to provide more housing might mean that sooner or later it will be built on. The searches that we conduct can not find this out even if building is already contemplated. You could, if you wish, make a visit to the local planning office and speak to a planning officer who may be able to give you more information.

We can also carry out other searches for you at your request. One of these is an environmental search. This may give you some idea of the use to which the site was previously put. Some people find them interesting and others not so we will not do one unless you specifically ask us to do so.

The Local Search gives no information about the drainage situation of your property. A Drainage search would give more information about the route of the drains or if, for example, there is a drain running under your property, which might affect you should you wish to build in the garden. If this is a particular issue for you please let us know.

As soon as all of our searches and enquiries have been completed, unless you are also selling at the same time, you will be asked to provide your deposit. This can be in the form of a cheque or, preferably by direct transfer in to our bank account. If you wish to use this method please ask for our bank details.

By all means suggest a completion date although your seller may not be able to accommodate the date that you would like. It is better to try to be flexible, particularly if there are a number of people in the chain who will all have different requirements. Any date at this stage is only a suggestion. Please do not book anything until we tell you that contracts have been exchanged.

Once contracts have been exchanged your completion date becomes fixed and you are legally obliged to complete your purchase on that date. The only exception to this is an “on notice” completion where you are buying a new property from a developer and the property is not yet ready for occupation.

Now that you are committed to the purchase of the property you should place on risk any insurance policies (life cover, endowments and buildings insurance) that you require. Do not wait until completion. Wherever possible please make sure that we receive details of any buildings insurance at least seven days before the date fixed for completion. If you are obtaining your own buildings insurance and you have a mortgage, then your lender lays down certain requirements for that buildings insurance. The following is an extract from the guide that we receive from the lenders setting out those requirements.

You will need to:

- check that the amount of buildings insurance cover is at least the amount referred to in the mortgage offer. If the property is part of a larger building and there is a common insurance policy, the total sum insured for the building must be not less than the total number of flats multiplied by the amount set out in the mortgage offer for the property.

- ensure that the buildings insurance cover is index linked.

- ensure that the excess does not exceed £1,000.00.

- check that all the following risks are covered:- fire, lightning, aircraft, explosion, earthquake, storm, flood, escape of water or oil, riot, malicious damage, theft or attempted theft, falling trees and branches and aerials, subsidence, heave, landslip, collision, accidental breakage of glass and sanitary ware and accidental damage to underground services.

- check that you have insured against public liability.

- check that your insurance company will note the interest of your lender on the policy.

You will receive (time allowing) a few days prior to completion a statement showing the amount that we will need to complete the purchase.

Could you please make sure that you have your cleared balance with us at least the working day before completion.

On the date fixed for completion we will be sending the balance of the amount due for the purchase of the property to the sellers solicitor. In order that there are no hold ups on the day we will have requested your lender to let us have your mortgage monies the day before completion. This will mean that you have to pay an additional days interest but if we leave it until the day of completion then we have no control over what time the mortgage monies come in from the lender and that could make completion late (which will involve you in paying penalties) or indeed mean that completion that day is not possible.

When the selling solicitors receive the completion money they will telephone the agents and authorise them to hand over the keys to you. Strictly, however, even if the money has arrived with the sellers solicitors the seller has until 1.00pm to hand in his keys. You may be lucky and get hold of the keys earlier but this can’t be guaranteed so you should base your plans around a completion time of about 1.00pm.

If we are depending upon monies coming in from your sale to complete your purchase then 1.00pm may be a little ambitious and you may have to be patient for a little longer. It is not unusual for you not to be able to get in to your new home until late afternoon!

This is intended for general guidance only. It has been written as a overview on this topic and is not intended as legal advice. The subject is obviously a lot more complex than detailed below and we are more than happy to talk to you further about it.

What is a covenant?

A covenant is something that was laid down at some point in the past when the land was transferred. It is an agreement between the parties that they will or won’t do something. The covenant remains with the land meaning that anyone who buys the land also has to agree to do or not do that particular thing.

What is a breach of covenant?

Quite simply, this means that something has been done which would appear to be in breach of the covenant.

How is a breach of covenant enforced?

The person with the benefit of the covenant would need to contact you to tell you to stop doing whatever you are doing which breaches the covenant or to otherwise put right the breach. If you failed to do so then they would need to go to the Court to seek an injunction or damages.

Is this something to worry about?

Covenants are known for being difficult to enforce. There are lots of reasons why a Court may not agree to enforce the covenant. Typically speaking, the older the covenant and the older the breach the less risk it poses.

Obviously we can’t tell you that it can’t ever be enforced and, even if it can’t, we can’t guarantee you that someone couldn’t still try to enforce it which would put you to cost and stress. We can only tell you that it is very unlikely.

What can we do about it?

There are really only three options when a breach has occurred:

- The person with the benefit of the covenant is located and their permission sought or they are asked to remove the covenant altogether.

- The breach is put right

- Indemnity Insurance is taken out

Options 1 and 2 are largely impractical. They would be time consuming and costly to do. We largely then rely on the 3rd option.

What is indemnity insurance?

Indemnity insurance policies are one off payment ‘band aids’ policies that are taken out when there is no other realistic solution to a problem. Each policy is different but these, however, are some general points that apply to nearly all policies:

- One payment is made for the policy (there are no ongoing payments)

- The policy should last forever

- The policy runs with the property rather than the owner (so can be passed on to future buyers)

- The limit of indemnity on the policy (so the maximum payment it will make) is the current value.

- The policy will cover very specific circumstances and contain a lot of exclusions

- Claims against these policies are rare. They are very cheap for a reason! The circumstances in which they can be used a very limited and you can fall foul of the exclusions and invalidate the policy very easily. You should read the terms of the policy carefully.

What will the policy cover?

In general we would expect the policy to cover:

- Legal fees for fighting any enforcement of the covenant claim

- Costs of obtaining retrospective consent under the covenant

- Loss to value of the property and costs of complying with the covenant

The insurance company would decide which option would be most cost effective to them.

It is important to note that you cannot make any contact with any third party about your covenant or any breach of covenant as you will invalidate the insurance.

The insurance will only cover breaches of covenant to the date of the policy and not any future breaches.

If you need more information or assistance with conveyancing in Chichester, Bognor Regis, Arundel, Emsworth, Portsmouth or Fareham (or anywhere else in the UK!) we’d be happy to assist.

This is intended for general guidance only. It has been written as a overview on this topic and is not intended as legal advice. The subject is obviously a lot more complex than detailed below and we are more than happy to talk to you further about it.

What is a rent charge?

In simple terms it is the money paid to the management company to maintain the estate.

Why is it a problem?

The Court case in question essentially allowed a management company to place leases over properties where the service charge had been unpaid for more than 40 days. In some case they were as little as £7 in arrears. The company then charged £500 to remove the leases once the arrears were paid. The Land Registry fought the company as they did not the placement of leases but lost in Court.

This means that if you get into arrears it may be possible for a lease to be placed on your property. The other issue is that some lenders don’t like these and it can come up on sale.

What can we do?

There are really three things we can do:

- If you always pay your service charge you cannot have a lease placed on your property in this way.

- We can take out insurance. This would protect any mortgage lender against the cost of a lease being placed on the property in the event they have to repossess. It does not protect you as you are in control of whether you pay the service charge or not. These are usually (but not always) acceptable to buyer’s solicitors and you can use it when you come to sell. We will always proceed with this option as standard unless you decide you want a deed of variation (as below)

- We can request a deed be entered into which adds some clauses to the title which prevents this from happening. The problem with this is that it can take a long time to do. It is also fairly expensive so sellers don’t like it.

This article is fairly good at explaining the situation in more depth but please note that it was written in April 2020 when the lenders and industry as a whole was a lot more worried about this issue and so deeds of variation were the standard course of action but now insurance is more acceptable. Read it here.

If you need more information or assistance with conveyancing in Chichester, Bognor Regis, Arundel, Emsworth, Portsmouth or Fareham (or anywhere else in the UK!) we’d be happy to assist.

This is intended for general guidance only. It has been written as a overview on this topic and is not intended as legal advice. The subject is obviously a lot more complex than detailed below and we are more than happy to talk to you further about it.

Sometimes there is a tendency to think that the funding needed to buy a property is actually more complex than it is! This has a lot to do with the hoops you jump through to get a mortgage and the word ‘deposit’ meaning something different to us than it does to mortgage lenders. I hope the below will make a little bit more sense.

Think of it like buying a car. You reserve a car whose full price is £20,000 and they ask you to pay a deposit of 10% (£2,000) on reserving the car and that’s the amount you stand to lose if you then don’t go ahead and buy. This is exactly the same with buying a house. Your deposit is always 10% regardless of how much your mortgage is (unless you are getting more than a 90% mortgage in which case you will need to talk to me although the principle remains the same).

Now with that car imagine you take out a loan with the bank of £15,000 to buy it. You will have paid £2,000, you have the loan of £15,000 so you need to make up the difference of £3,000 and also need to pay the dealers fees and maybe some extras you have put on (we’ll call that the disbursements). This entire amount we call the balance.

Buying a house is no different! The confusion comes from the idea that the money you are putting over and above your mortgage is the deposit but it isn’t. It is actually just the balance after your loan!

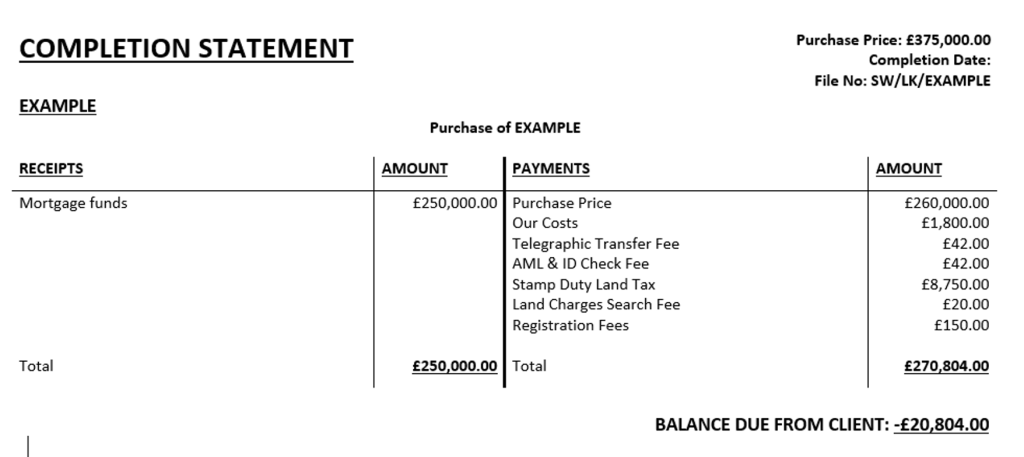

Essentially then, we produce a statement that shows exactly how much we need to buy the property for you. This is the purchase price plus the disbursements (Land Registry fees, legal fees etc). From this we take off the amount we are getting from your lender (and any other money we are receiving direct for the purchase from other sources such as the bonus from help to buy ISAs). We will also deduct any money you have sent us at that point. That then leaves a balance for you to pay.

This is an example of what your completion statement might look like:

If you need more information or assistance with conveyancing in Chichester, Bognor Regis, Arundel, Emsworth, Portsmouth or Fareham (or anywhere else in the UK!) we’d be happy to assist.

This is intended for general guidance only. It has been written as a overview on this topic and is not intended as legal advice. The subject is obviously a lot more complex than detailed below and we are more than happy to talk to you further about it.

Indemnity insurance policies are one off payment ‘band aids’ policies that are taken out when there is no other realistic solution to a problem. We use them most often for the following:

- Breach of building regulation consent and/or planning

- Breach of covenant

- Lack of rights (easements)

- Rent Charges

As each policy type has a different purpose I have provided some detail below on these common uses so please have a look at the section that relates to your policy. These, however, are some general points that apply to all policies:

- One payment is made for the policy (there are no ongoing payments)

- The policy should last forever

- The policy runs with the property rather than the owner (so can be passed on to future buyers)

- The limit of indemnity on the policy (so the maximum payment it will make) is the current value.

- The policy will cover very specific circumstances and contain a lot of exclusions

- Claims against these policies are rare. They are very cheap for a reason! The circumstances in which they can be used a very limited and you can fall foul of the exclusions and invalidate the policy very easily. You should read the terms of the policy carefully.

Breach of Building Regulation Consent and/or Planning

It is fairly common for no planning or building regulation consent to be obtained. The policy will typically cover:

- Legal fees for disputing an enforcement notice by the Council

- The costs of bringing the work up to building regulation standard or removing the offending works if enforcement action is taken by the Council

- The loss of value to the property caused by the offending work being removed (for example a conservatory being taken away) if enforcement action is taken by the Council.

The insurance company would decide which option would be most cost effective to them.

You will notice that in all circumstances it covers works needed if the Council takes enforcement action. It will not cover defects to the property caused by the work being done incorrectly or frankly anything else that might actually be useful! It also doesn’t help if you want to carry out future works which are affected by the lack of current sign off.

The Council have 1 year to enforce against building control breaches and 4 years for planning. If the works in question are outside these time limits then the policy will serve little purpose honestly.

It is important to note that the policy will be invalidated if you contact the Council, for example to discuss the work or to apply for further consents. The Council must take entirely spontaneous enforcement action against you for the policy to be used.

Breach of Covenant

Covenants are the ‘do’s and don’ts’ contained in the title. Most breaches occur because people simply have no idea those covenants are there or it would be impractical to get consent under the covenant. Covenants are fairly difficult to enforce anyway but the policy will typically cover:

- Legal fees for fighting any enforcement of the covenant claim

- Costs of obtaining retrospective consent under the covenant

- Loss to value of the property and costs of complying with the covenant

The insurance company would decide which option would be most cost effective to them.

It is important to note that you cannot make any contact with any third party about your covenant or any breach of covenant as you will invalidate the insurance.

The insurance will only cover breaches of covenant to the date of the policy and not any future breaches.

Lack of Rights (easements)

Sometimes titles just don’t have the rights (which we call easements) they should. Most commonly this relates to no right to use a footpath or roadway that you need to use to access the property or otherwise enjoy use of the property. If someone formally tries to stop you using the right the insurance typically covers:

- Legal fees for fighting any attempt to stop you using the access

- Costs of obtaining formal consent

- Loss to the value of the property from having the right removed

The insurance company would decide which option would be most cost effective to them.

It is important to note that you cannot make any contact with any third party about your easement as you will invalidate the insurance.

Rent Charges

This is a slightly complicated issue that is fairly new. It came about due to a Court case within the last few years and created a new law effectively which allows owners of communal areas on estates to place leases on houses where the service charge has remained unpaid for a period of time. They then charged £600 to remove the leases. It was an entirely a money making exercise and not something we expect to see happen very often since it is completely unethical and so very damaging for any company’s reputation to do this. However, since it is possible we can take out an insurance policy that would cover the cost of removing the lease. You should note though that this policy will only typically pay out in the event that you were not provided with invoices from the company. You cannot simply not pay then expect the insurance company to sort out the mess basically!

If you need more information or assistance with conveyancing in Chichester, Bognor Regis, Arundel, Emsworth, Portsmouth or Fareham (or anywhere else in the UK!) we’d be happy to assist.